I have been learning about investing and saving a small amount of cash for making investments. I started investing after I paid off my credit card debts. I set up Acorns (disclosure: referral link, I get $500 when 3 of you sign up!) and Wealthfront (disclosure: referral link, I’d get $5,000 managed for free, and so will you.) and they invest with my savings (a different savings from my emergency fund).

I’ve also opened a Robinhood account (disclosure: referral link, you and I will both get a free stock, picked by Robinhood) to invest in stocks. Robinhood has had bad press because its user experience could encourage gambling behaviors. However, I invest with caution and Robinhood works perfectly well for me. I use Robinhood to trade stocks, ETFs, and Cryptocurrencies, and I pay no commissions on my trades.

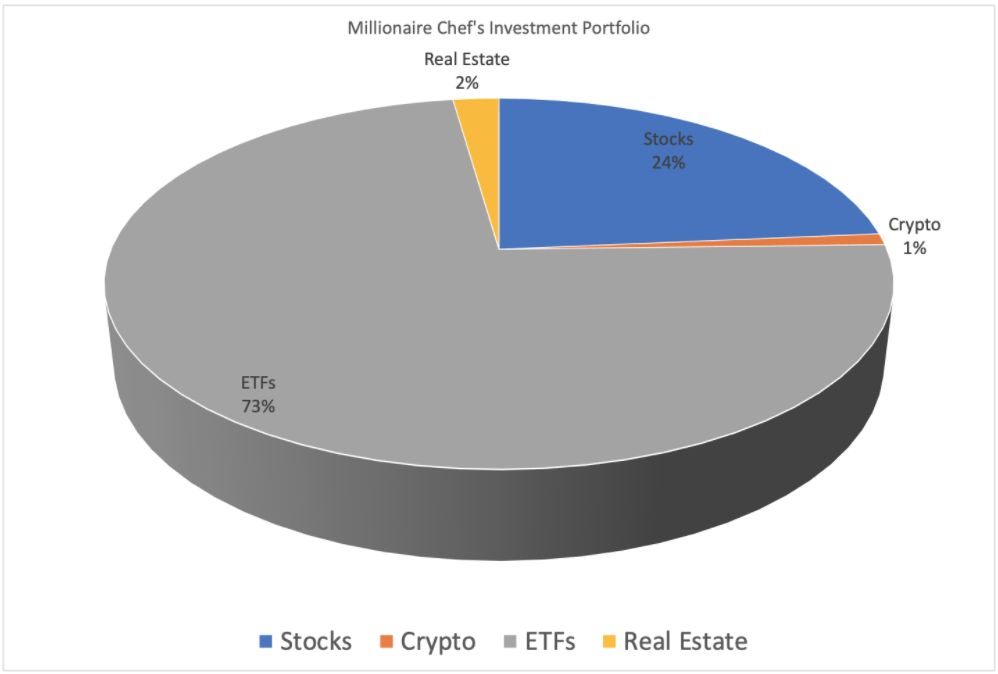

First and foremost, I invest 20% ~ 23% of my income. My Investments are broken down into the categories below:

– Stocks

– ETFs – Exchange Traded Funds, an investment that tracks the performance of an index or a sector

– Real Estate

– Cryptocurrencies

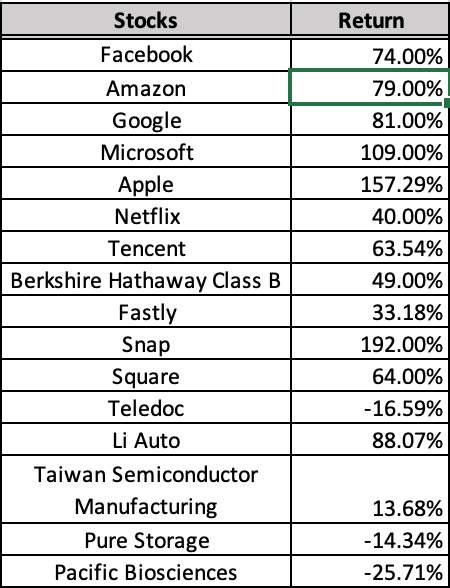

My stock portfolio contains mostly mature companies that have a good track record in management and the ability to innovate. Periodically, I’d invest in small firms that are young and promising in their product development. I like investing in technology and innovations. However, investing in technology is risky; therefore, I balance my investment with safer bets on great companies such as Microsoft, Google, Amazon, Facebook, and Apple. My returns are based on 1 to 3.5 years of investment.

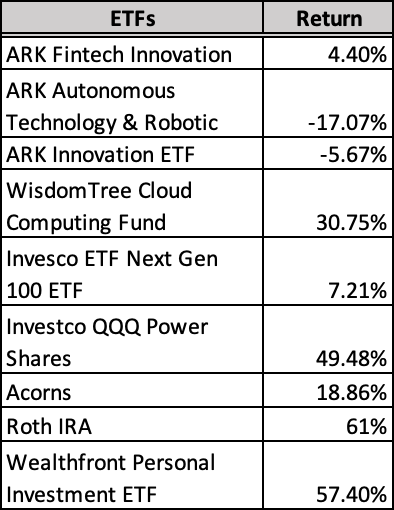

Besides buying individual stocks, I also invest heavily in ETFs, Exchange Traded Funds. Investing in ETFs gives me a chance to invest in a group of stocks and track their performance altogether; I invest mostly in technology and innovation ETFs. My biggest position is in WisdomTree Cloud Computing Fund, and it tracks some of the biggest names in the tech industry: Paypal, Zoom, Adobe, Square, and Dropbox. We used these apps a lot and they will be around for a while, with COVID or not. My returns are based on 1 to 3.5 years of investment.

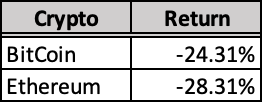

I’ve started to invest in cryptocurrencies, Bitcoin and Ethereum, in 2021. From learning about the history of fiat currency, I believe money will be treated differently in the future given the rising in e-payment and innovation in cybersecurity. However, I invest in cryptocurrencies with caution since they are still immature and volatile. And yikes…I haven’t been doing so well in this category. My returns are based on 6-months of investment.

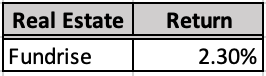

Last but not least, I used Fundrise to invest in real estate. Fundrise is a robo-advisor, and it invests my money according to my investment goals. I don’t invest in real estate as frequently as I do with other types of investment. I get better returns on investing in equities with cash I save; therefore, I will hold off on adding more money to my Fundrise account.

I invest with an intention to grow wealth in the long term. I have no intention of taking out any of my investments until I retire. Therefore, I practice restraint and only invest the money I have left after paying my rent, credit card, and other basics.

I invest with an intention to grow wealth in the long term. I have no intention of taking out any of my investments until I retire. Therefore, I practice restraint and only invest the money I have left after paying my rent, credit card, and other basics.