Credit card is a useful tool to save money if used strategically.

There are two types of credit card options, cash back vs. travel cards.

Cash back cards earn you a percentage of cash based on the money you spend, generally between 1% to 6%, while travel cards give you points and you can convert them to cash when you purchase airline or train tickets.

I only use 1 credit card, and it is a travel card. My rules for using a credit card are the following:

– only spend what I could pay off at the end of each month

I have a monthly budget and I stick to my goals and only spend accordingly.

– automate my monthly payment to avoid late fees

I automate my credit card payment to avoid late fees. However, I still remember the payment date in order to track my monthly spending, which ultimately is the plan to focus on living.

– use my credit card as much I can for fixed costs (utilities, MetroCard, subscriptions)

I optimize my credit card to earn travel points. Using my credit card towards household spendings helps me optimize my reward even if I don’t spend money elsewhere.

– only use my points for traveling because I get the most return when I convert my points to purchase tickets

I consolidate my credit card usage towards one travel card because my goal is to travel and do it cheaply. Therefore, I only redeem my points towards airline tickets, which gives me the best return on my investment.

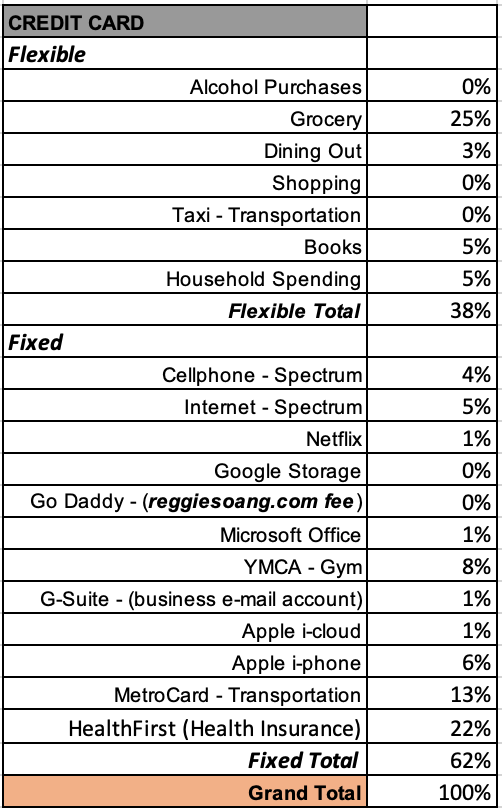

Here’s the snapshot of my current credit card spending:

*The total amount is approximately 25%~28% of my income.